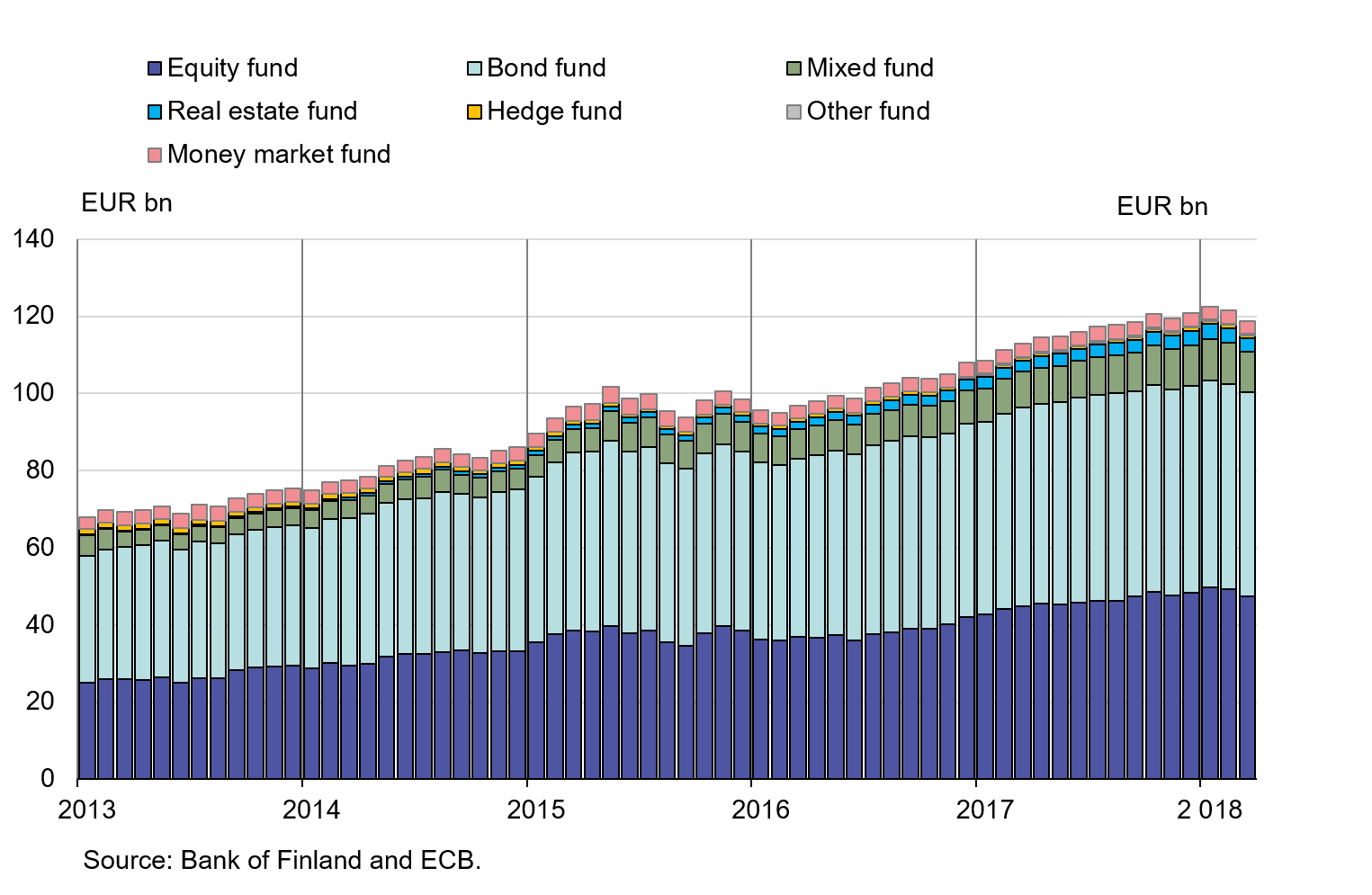

Investment fund capital contracted in the first quarter of 2018

The protracted growth in investment funds registered in Finland turned negative in the first quarter of 2018. The aggregate fund capital contracted from the peak of EUR 122 bn at the end of January to EUR 119 bn at the end of March. Quarter-on-quarter, the contraction was also the largest recorded since the third quarter of 2015.

Of the decline in fund capital, about EUR 2.6 bn was due to negative valuation changes, which reflected, above all, large value depreciations of domestic and Swedish shares: EUR -0.9 bn in February and EUR -1.6 bn in March.

Despite negative valuation changes, Finnish investment funds registered a net inflow of EUR 0.9 bn in new investments in the first quarter of 2018. Equity funds attracted the largest new investments (EUR 0.6 bn), followed by real estate funds (EUR 0.2 bn) and mixed funds (EUR 0.2 bn). For bond and money market funds, in turn, withdrawals exceeded new investments by EUR 2.0 bn.

Real estate funds still popular with households

Even though growth turned negative in the first quarter of 2018 for the majority of investment funds, open-end real estate funds grew further. Their fund capital grew by 3.4% from the end of 2017, and at end-March 2018 the value of open-end real estate funds was EUR 3.9 bn.

Open-end real estate funds also appear to have sustained their popularity at the annual level. By end-March 2018, their value had grown by as much as 33% from March 2017. These funds have grown even faster than closed-end real estate funds, the fund capital of which grew only marginally in 2017 and totalled EUR 3.1 bn at the end of the year.

Finnish open-end real estate funds are especially favoured by Finnish households. At end-March, Finnish households accounted for 39% (EUR 1.4 bn) of direct holdings in these funds. Non-financial corporations accounted for 18% (EUR 0.7 bn) and insurance corporations for 14% (EUR 0.5 bn). The share of real estate funds in Finnish households' total investments in all domestic investment funds has tripled in three years, to 6.6% at end-March 2018

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact:

Topias Leino, tel. +358 9 183 2315, email: topias.leino(at)bof.fi,

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila(at)bof.fi

The next investment fund news release will be published at 1 pm on 1 August 2018