Finnish investment funds bolstered by depreciating euro in 2018 Q2

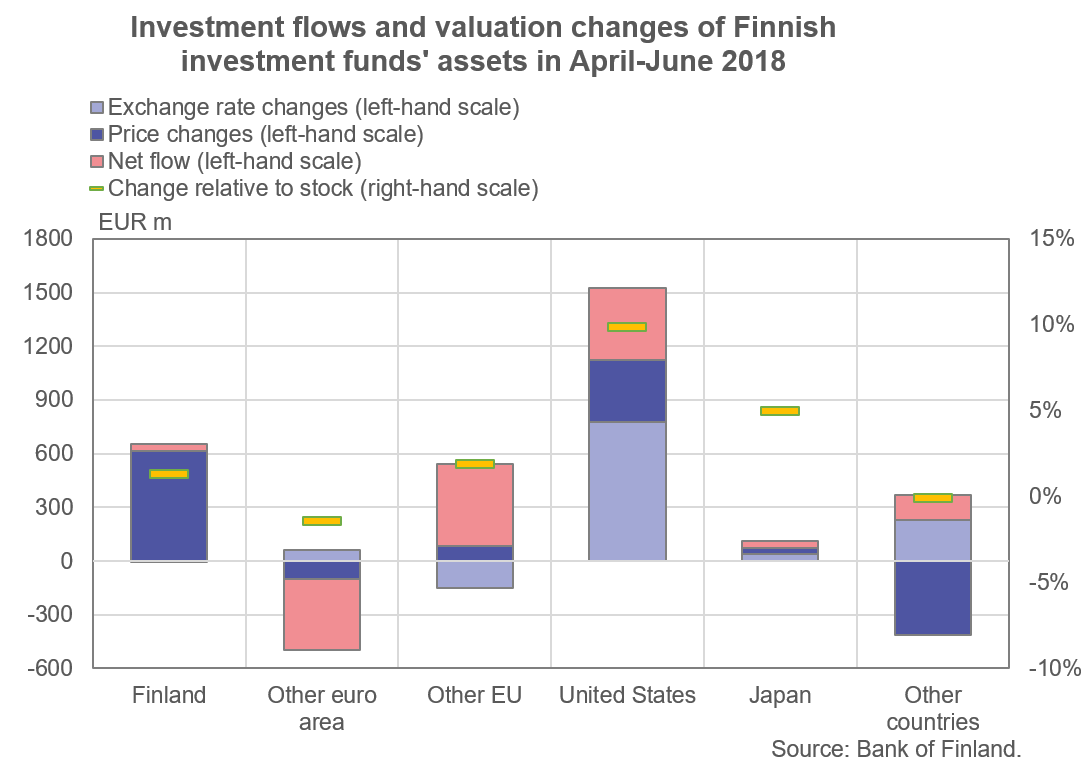

The aggregate fund capital of investment funds registered in Finland increased by 1.6% (EUR 1.9 bn) in the second quarter of 2018. Net inflows remained negligible during this period, and thus capital growth was mainly driven by the value appreciation of funds' assets. Of this, approximately one-third was due to price change, whilst the remainder stemmed from changes in exchange rates.

The euro depreciated by 5.4% against the US dollar during the second quarter, which raised the euro value of funds' dollar-denominated assets by the same amount. In all, exchange rate movements boosted the value of Finnish investment funds' assets by 0.8% (approx. EUR 1 bn). On the other hand, fund investments channelled into Sweden, for example, weakened due to the Swedish krona's depreciating against the euro.

Fund valuations were also supported by rising equity prices during April–May, especially in Finland and in the United States. In total, price changes in equities boosted Finnish investment fund assets by EUR 0.6 bn.

At the end of June 2018, the aggregate fund capital of investment funds domiciled in Finland stood at EUR 121 bn. Of this, 40% comprised non-euro denominated assets.

Real estate funds attracted majority of new investments

Although Finnish investment funds overall attracted little new capital from net subscriptions during the second quarter, investors did adjust the weighting of their asset allocation between fund classes.

The largest share of net subscriptions was made into real estate funds, at approximately EUR 0.3 bn. Real estate funds accounted for the majority of net subscriptions throughout the entire first half of the year, totalling almost EUR 0.6 bn and comprising approximately 60% of all net subscriptions received by Finnish investment funds.

Mixed funds attracted a similar volume of net subscriptions in the first half of 2018, at EUR 0.5 bn. Money market funds, on the other hand, experienced net withdrawals of EUR 0.3 bn.

The value of assets under management in open-end real estate funds amounted to EUR 4.2 bn at the end of June. In addition, closed-end real estate funds held just over EUR 5 bn worth of assets. By sector of holder, households held the largest number of shares of open-market real estate funds, while employee pension institutions accounted for the largest quantity of shares in closed-end funds.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact:

Topias Leino, tel. +358 9 183 2315, email: topias.leino(at)bof.fi,

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila(at)bof.fi

The next investment fund news release will be published at 1 pm on 1 Noverber 2018