Investment funds continued to expand in the third quarter of the year

However, in September investors reduced their investments in fixed income funds.

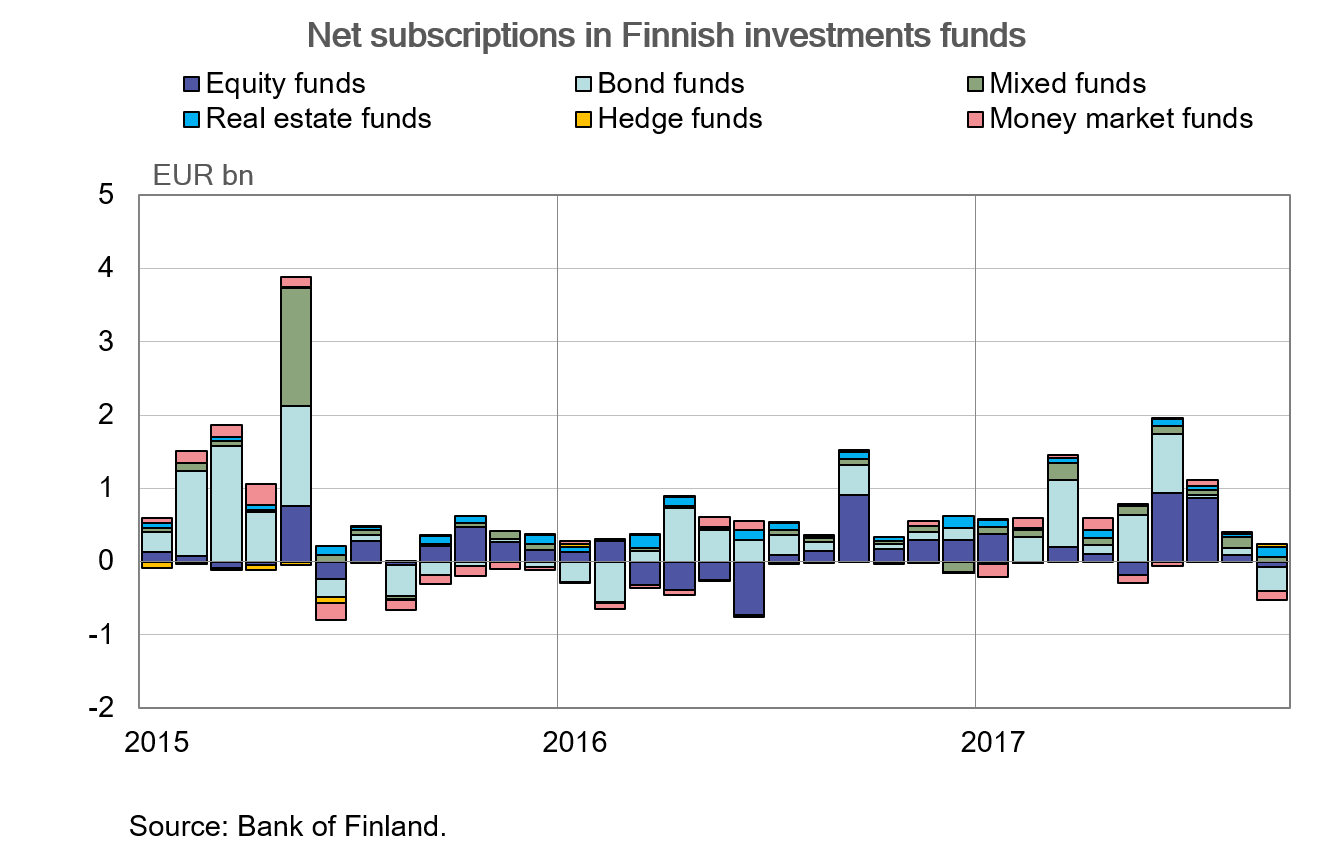

Net investments in investment funds registered in Finland have been positive in nearly every month of the current year. The value of the aggregate fund capital increased by roughly EUR 10 billion between January and September. Of this rise, a little over EUR 6 billion was accounted for by new investments, while just under EUR 4 billion reflected changes in prices and exchange rates.

In contrast to the first half-year, withdrawals from funds exceeded new investments by EUR 0.4 billion in September. In July and August, net fund investments were still clearly positive, at a total of EUR 1.7 billion.

The withdrawals made in September mainly concerned bond funds and money market funds, amounting to EUR 372 million on net and EUR 138 million on net, respectively. Holdings were redeemed above all by financial and insurance corporations, non-financial corporations and general government. The redemptions concerned especially funds investing in debt securities issued by euro area general government and non-financial corporations.

The popularity of equity funds was still strong in July, with a net capital inflow of EUR 0.9 billion. However, in August new investments in equity funds declined to EUR 74 million in net terms, and in September turned negative by EUR 41 million. In the third quarter, households increased their investments in equity funds, whereas non-financial corporations reduced these holdings.

Among the other fund types, mixed funds and property funds attracted the most of new investment in the third quarter, with EUR 0.3 billion on net and EUR 0.2 billion on net, respectively.

Regardless of the decline in fund investments, aggregate fund capital continued to post marked growth also in September. This trend was above all due to positive valuation changes in equity funds amounting to EUR 1.1 billion. At the end of September, the value of the aggregate fund capital was EUR 118 billion.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact:

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila(at)bof.fi

Topias Leino, tel. +358 9 183 2315, email: topias.leino(at)bof.fi

The next investment fund news release will be published at 1 pm on 1 February 2018.