Fund investors’ risk appetite grew in 2016

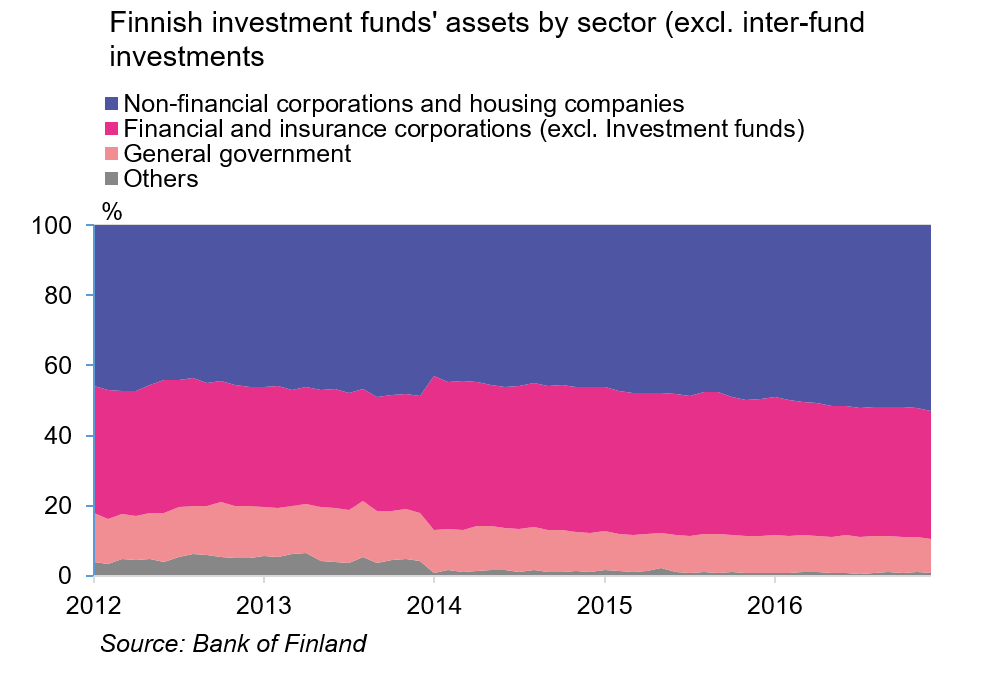

Over the recent years, an increasing share of investments in Finnish investment funds has been channelled into non-financial corporations and real estate, while at the same time the weight of sovereign bond investments has notably decreased. In addition to these developments, fund portfolios reflected 2016 by e.g. the divergence between euro area and US monetary policy, the problems of the European banking sector and Brexit.

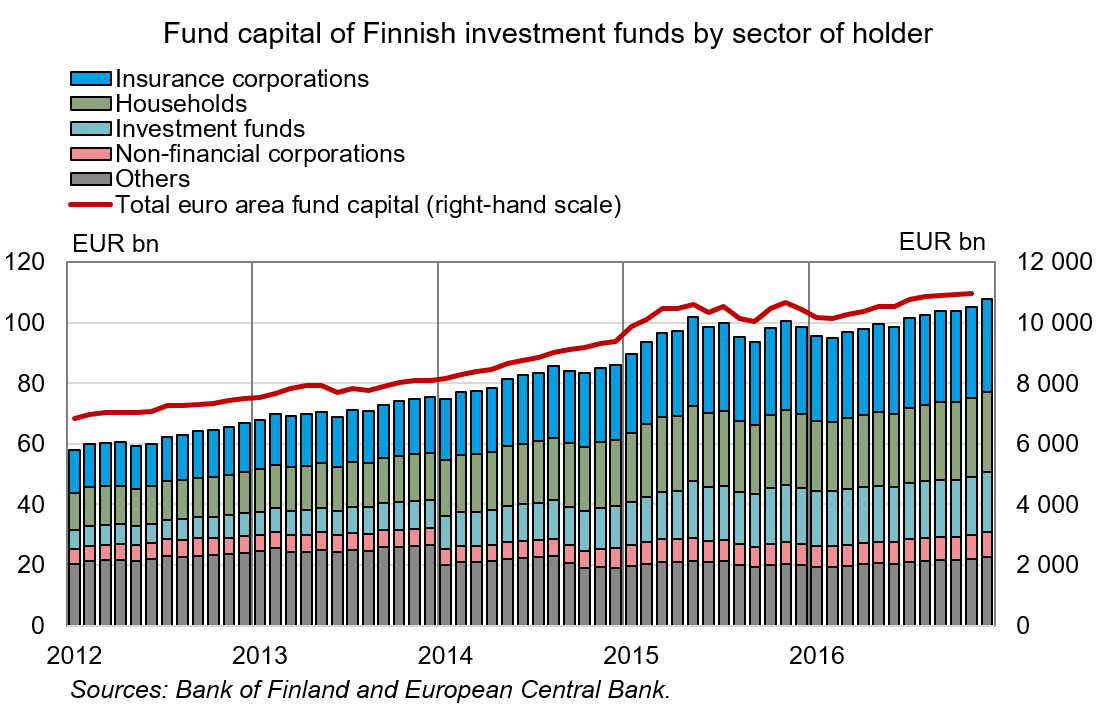

In 2016, Finnish investment funds attracted about EUR 4.1 bn in net new investments. The previous year's share market fluctuations were still reflected in early 2016 as modest capital inflows in investment funds. From March onwards, however, subscriptions in Finnish investment funds generally surpassed redemptions.

The highest increase in fund investments, EUR 1.2 bn in net terms, was by the household sector, followed by non-financial corporations, with an increase of around EUR 1 bn.

Monthly valuation changes also turned robustly positive in April, remaining in positive territory throughout the year. This boosted fund capital by a total of EUR 5.2 bn in 2016. At the end of 2016, the

total value of Finnish fund capital was EUR 107.9 bn.

Strong growth in real estate investments

The historically low level of interest rates has encouraged fund investors to seek investments with higher returns and risks. In Finland, this was reflected in 2016 particularly as a considerable increase in investments in real estate funds.

Investment funds investing in real estate gathered about EUR 1 bn in new net subscriptions. In addition to this, some of the funds used leverage to finance their investments. As a result, the investment assets of these funds grew by almost 70% on the previous year, totalling EUR 3.4 bn at the end of 2016.

In addition to open-end investment funds, closed-end real estate funds are also significant real estate investors in Finland. At the end of September 2016, the value of assets managed by these funds totalled EUR 4.8 bn.

Over 80% of the assets of both open-end and closed-end real estate funds are invested in Finland.

Increase in investments into corporations, decrease in investments into other euro area banks

In euro terms, bond funds attracted the largest net new investments in 2016, almost EUR 2 bn. The majority of these investments went into debt securities issued by Finnish and Swedish non-financial corporations.

Net new investments in equity funds amounted to EUR 0.7 bn. Here, too, the majority of new investments flowed into non-financial corporations.

News of some euro area banks' problems was mainly reflected in Finnish fund portfolios as an active reduction in the weight of the other euro area banking sector, while at the same time, the weight of the Finnish banking sector was markedly increased.

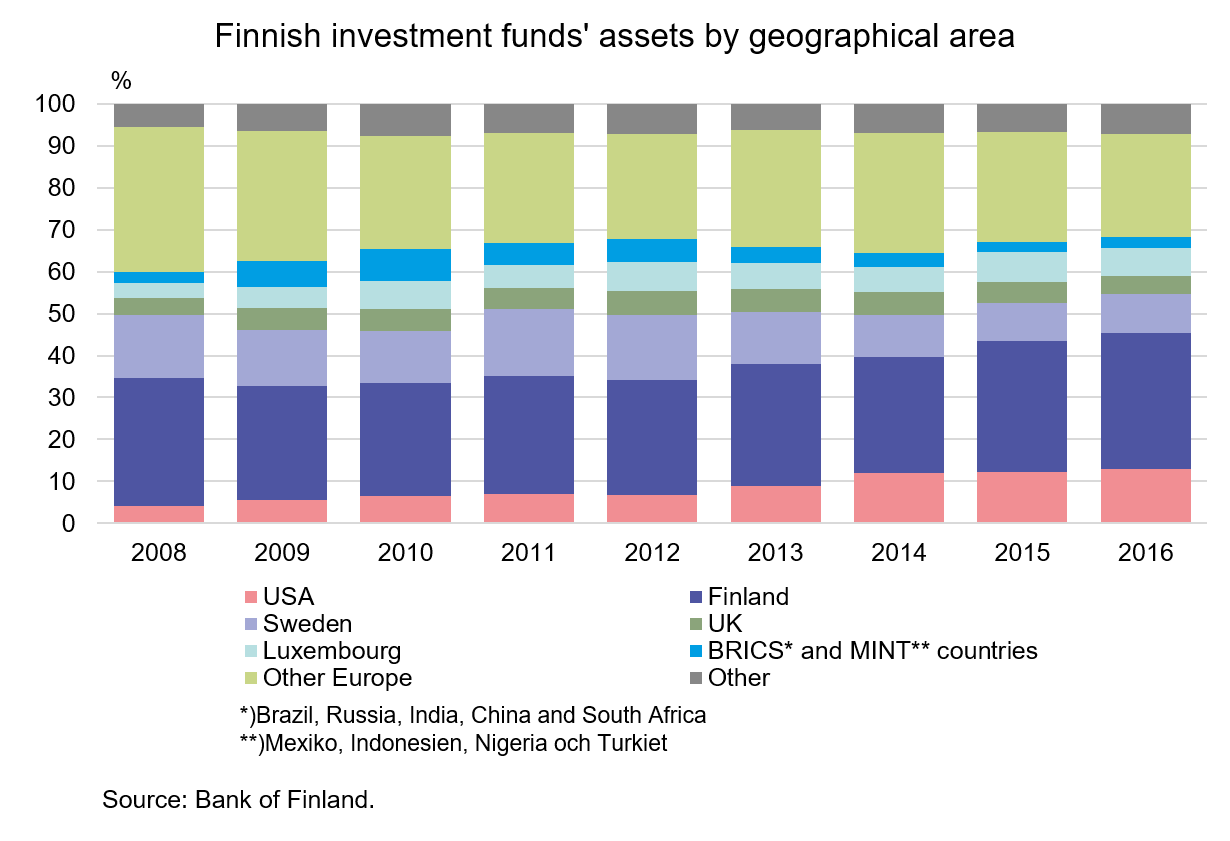

Finland's and the USA's share in investments increased, UK's share decreased

The portfolio weight of investments in Finland grew during the year by 32.5% (+1.4 percentage points). This was mainly explained by new investments in funds, of which about 60% (EUR 2.6 bn) was channelled into Finland during the year, and by higher equity prices.

The share of investments in USA grew to 13% (+0.7 percentage point) in 2016. The main factor to this was the rise in equity prices that continued almost throughout the year. In addition, the appreciation of the US dollar before and after the Federal Reserve's interest rate rise in December boosted the euro-value of investments.

The shares of investments in Finland and the USA have both grown for several years. However, Finland's higher share is largely explained by growth in Finnish inter-fund investments.

The share of investments in the United Kingdom contracted during the year, to 4.2% (–0.8 percentage point). About half of this was explained by redemptions, and half by the depreciation of the pound sterling against the euro in the aftermath of the news of the UK's exit from the EU.

Despite the contraction, the share of investments in the UK was roughly at the same level at the end of 2016 as in the previous year on average.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact

Topias Leino, tel. +358 10 831 2315, email: topias.leino@bof.fi

Tommi Aarnio, tel. +358 10 831 2480, email: tommi.aarnio@bof.fi

The next investment fund news release will be published at 1 pm on 2 May 2017.