Market developments led to capital outflow from investment funds

The fund capital of investment funds registered in Finland declined by EUR 1.7 bn, i.e. 1.7%, in the first quarter of 2016. A large part of the decline (EUR 1.4 bn) was explained by negative valuation changes and the rest (EUR 0.3 bn) by redemptions.

|

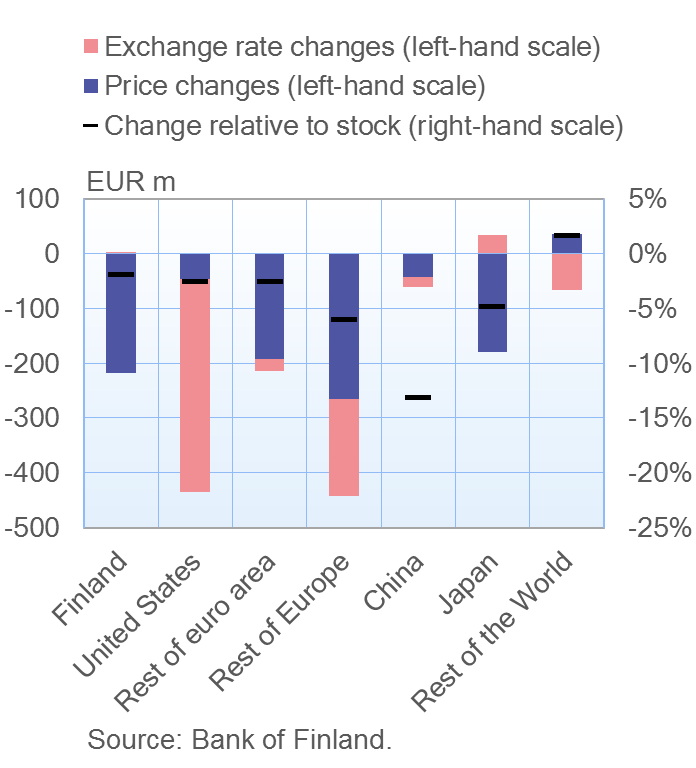

In the first quarter, the value of Finnish funds' equity investments was affected most by developments in Europe, the United States and Japan. In addition to share price declines, exchange rates also played a key role. In euro terms, the largest valuation changes in the first quarter of the year were in equity investments in the United States and non-euro area European countries, both of which registered a value loss of over EUR 0.4 bn. However, share price movements do not fully explain the observed developments. Particularly with regard to US shares, the actual price collapse only accounted for 10% of the total valuation adjustment, as the depreciation of the dollar against the euro simultaneously led to a significant reduction in the euro-denominated value of investments. In relative terms, the value of equity investments in China recorded the largest decline, more than 13%. Even so, the change due to Chinese shares remained fairly small in absolute terms, as equity investments in China accounted for a relatively small proportion of all investments. |

Valuation changes in Finnish funds' equity investments by country

|

Key statistical data on investment funds registered in Finland, preliminary data |

For further information, please contact

Tommi Aarnio, tel. +358 10 831 2480, email: tommi.aarnio@bof.fi, Topias Leino, tel. +358 10 831 2315, email: topias.leino(at)bof.fi. The next investment fund news release will be published at 1 pm on 1 August 2016. |