2015 an eventful year for investment funds

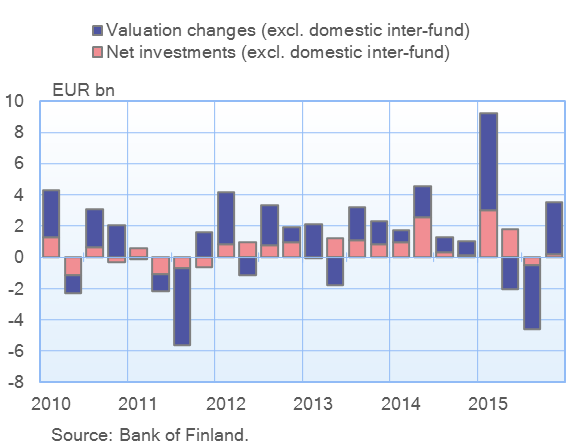

The fund capital of investment funds registered in Finland grew during 2015 by a total of EUR 12.4 bn. EUR 8.7 bn of the growth stemmed from net subscriptions to investment funds and EUR 3.8 bn from valuation changes in investments. Fund capital was affected in the course of the year e.g. by euro area developments, internal investment arrangements in the sector and, particularly towards the end of the year, by China.

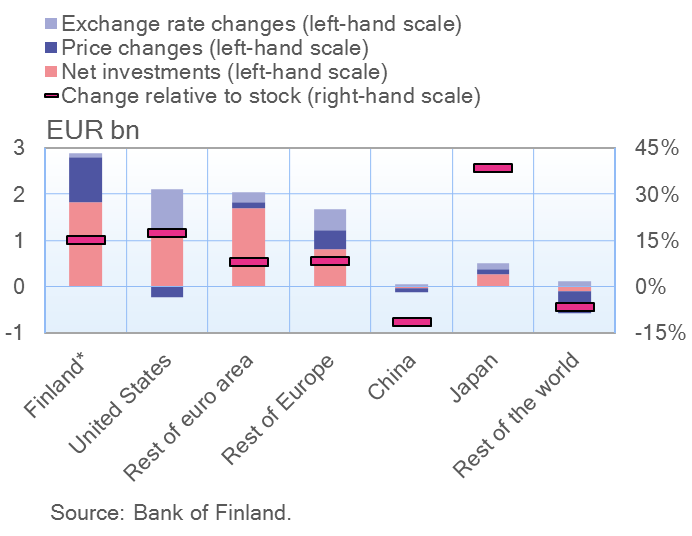

In the first quarter of the year, the value of Finnish fund capital increased considerably, especially as a result of rising share prices in Finland and elsewhere in Europe. At the same time, euro depreciation boosted the value of investments quoted in other currencies, notably the US dollar. |

Net investments in and valuation changes of Finnishinvestment funds, quarterly breakdown 2010–2015

|

| Developments in China were widely reflected in global share prices and also in Finland, as e.g. large valuation changes in domestic investment funds. From early-June to end-September, valuation changes reduced Finnish investment funds’ shareholdings by EUR 4.6 bn (13.4%). Of the total fund capital, EUR 7.2 bn (7.1%) was lost due to valuation changes. Net subscriptions to Finnish investment funds turned negative in June and remained fairly modest throughout the rest of the year. New investments focused mainly on real-estate and equity funds, whereas bond funds were subject to withdrawals. Inflows of new capital into Finnish investment funds amounted to just EUR 0.2 bn in the latter half of the year. Valuation changes turned to a positive EUR 3.8 bn in the fourth quarter of the year. At the end of 2015, the total value of Finnish fund capital was EUR 98.5 bn. | |

| ||

Key statistical data on investment funds registered in Finland, preliminary data | ||

For further information, please contact

Topias Leino, tel. +358 10 831 2315, email: topias.leino(at)bof.fi, Tommi Aarnio, tel. +358 10 831 2480, email: tommi.aarnio@bof.fi. The next investment fund news release will be published at 1 pm on 2 May 2016. |