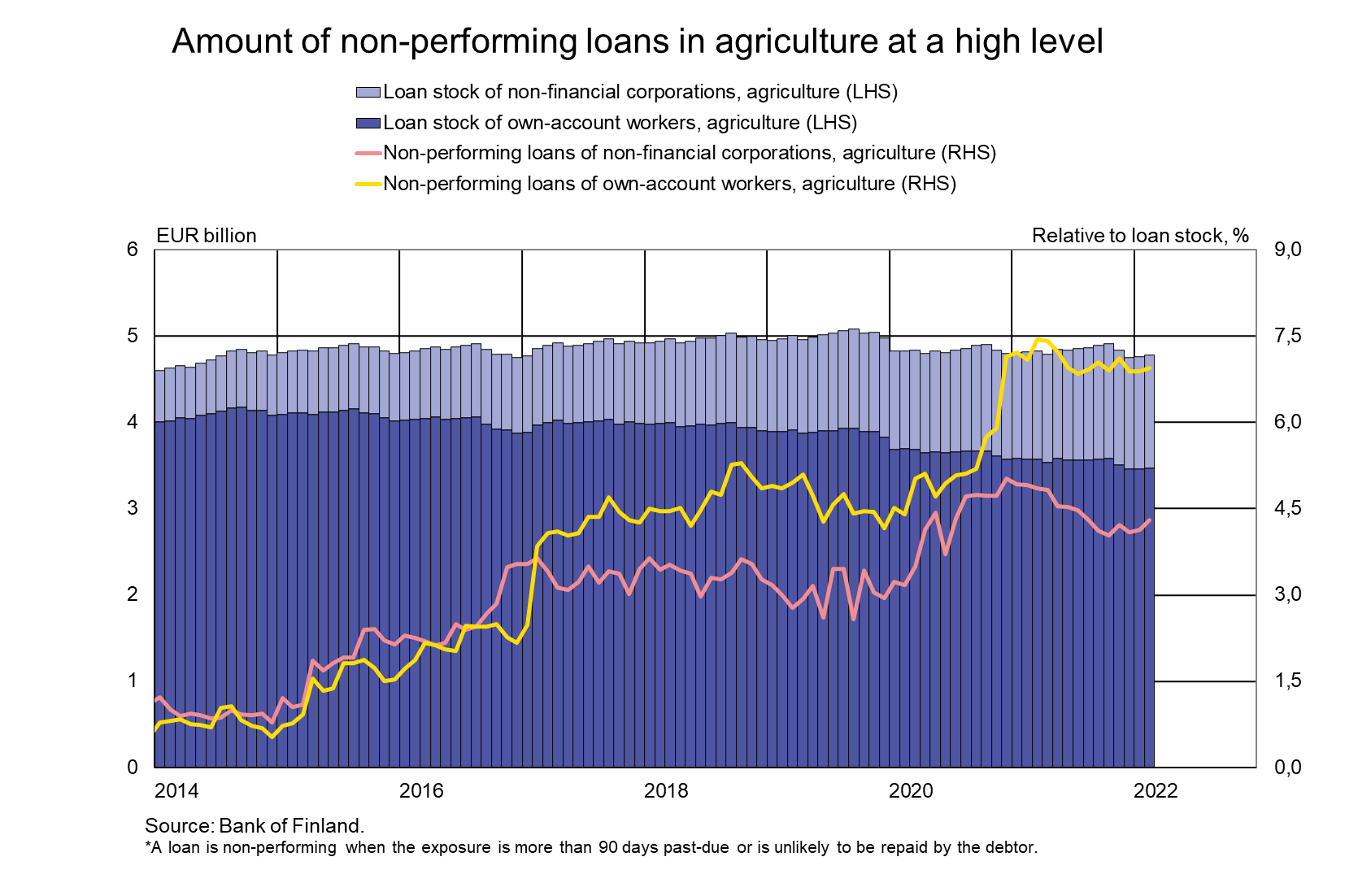

Amount of non-performing loans in agriculture at a high level

At the end of February 2022, bank loans granted to agricultural enterprises totalled EUR 4.8 bn. Most of these loans[1] (EUR 3.5 bn) were granted to own-account workers, which are included in the household sector. The stock of loans to agricultural companies totalled EUR 1.3 bn.

The number of farms has decreased in recent years. At the same time, however, farm incorporations into limited companies have increased[2] and, consequently, so has the number of limited companies. Changes in the company type have also been reflected in banking statistics: in February 2022, the annual change in the stock of loans for pursuing agricultural business as a private individual was ‑4.2%. The stock of these loans has contracted since 2018. At the same time, the stock of loans for agricultural business as a company has expanded, and in February the stock of these loans grew at a rate of 6.8%.

The amount of non-performing loans (NPLs) in agriculture has grown sharply over the past few years, although the growth came to a halt in the past year. In February 2022, the stock of NPL[3]s of agricultural own-account workers, in particular, was large (6.9%) in proportion to the total loan stock. The stock of NPLs of agricultural companies in proportion to the loan stock (4.3%) was also at a higher level than the corresponding percentages on average for non-financial corporations in other industries. The prices of agricultural production inputs have increased exceptionally in a short time[4], which may be reflected in additional problems in future.

Loans

Finnish households drew down EUR 1.7 bn of new housing loans in February 2022, down EUR 20 million on the same month last year. Of the new housing loans, buy-to-let mortgages accounted for EUR 170 million. The average interest rate on new housing loan drawdowns rose from January, to 0.85%. At the end of February 2022, the stock of housing loans stood at EUR 107.1 bn, and the annual growth rate of the stock was 3.8%. Buy-to-let mortgages accounted for EUR 8.7 bn of the housing loan stock. Out of all loans of Finnish households at end-February, consumer credit accounted for EUR 16.7 bn and other loans for EUR 18.3 bn.

Drawdowns of new loans[5] by Finnish non-financial corporations in February 2022 totalled EUR 1.8 bn, of which loans to housing corporations accounted for EUR 350 million. The average interest rate on new corporate loan drawdowns declined from January, to 1.7%. At the end of February, the stock of loans to Finnish non-financial corporations stood at EUR 99.4 bn, of which loans to housing corporations accounted for EUR 40.0 bn.

Deposits

The stock of Finnish households’ deposits at end-February 2022 stood at EUR 110.2 bn, and the average interest rate on the deposits was 0.03%. Overnight deposits accounted for EUR 101.3 bn and deposits with agreed maturity for EUR 2.2 bn of the deposit stock. In February, Finnish households concluded EUR 50 million of new agreements on deposits with agreed maturity, at an average interest rate of 0.29%.

| Loans and deposits to Finland, preliminary data | |||||

| December, EUR million | January, EUR million | February, EUR million | February, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,719 | 142,023 | 142,098 | 3,9 | 1,30 |

| - of which housing loans | 106,997 | 107,051 | 107,134 | 3,8 | 0,79 |

| - of which buy-to-let mortgages | 8,641 | 8,686 | 8,732 | 0,92 | |

| Loans to non-financial corporations2, stock | 99,337 | 98,959 | 99,417 | 2,9 | 1,21 |

| Deposits by households, stock | 109,006 | 109,409 | 110,238 | 5,2 | 0,03 |

| Households' new drawdowns of housing loans | 1,807 | 1,419 | 1,668 | 0,85 | |

| - of which buy-to-let mortgages | 179 | 148 | 166 | 1,00 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release will be published at 10 a.m. on 3 May 2022.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Loans granted to own-account workers for the purpose of pursuing a profession.

[2] Source: The Natural Resources Institute Finland, PxWeb - Select table (luke.fi/en). Since the beginning of 2018, under certain conditions, farm incorporation has no longer been subject to transfer tax.

[3] A loan is non-performing when the exposure is more than 90 days past-due or when it is is unlikely to be repaid by the debtor.

[4] Source: Statistics Finland, Statistics Finland - Index of purchase prices of the means of agricultural production

[5] Excl. overdrafts and credit card credit.