Stock of household deposits growing at a rapid pace

At the end of November 2019, the total stock of household deposits amounted to EUR 95.6 bn and the average interest rate on the deposits was 0.11%. The vast majority of household deposits, EUR 82.6 bn, are held in transaction accounts. The stock of transaction accounts grew by EUR 880 million during November and the average interest rate declined to 0.07%.

Deposits with an agreed maturity and other deposits account for a lesser share of the total stock of household deposits. At the end of November 2019, deposits with an agreed maturity totalled EUR 4.8 bn and other deposits EUR 8.2 bn. The interest rate on the stock of deposits with an agreed maturity has no longer declined in 2019, standing at 0.51% in November. Credit institutions apply a higher interest rate on deposits of over 1 year (0.94% in November 2019) than on deposits with shorter maturity (0.28% in November 2019). Deposits of over one year include e.g. ASP deposits – savings deposits for first home purchase – on which banks pay an interest of 1%. In November, households concluded EUR 235 million of new agreements on deposits with an agreed maturity, and the average interest rate on these was 0.15%.

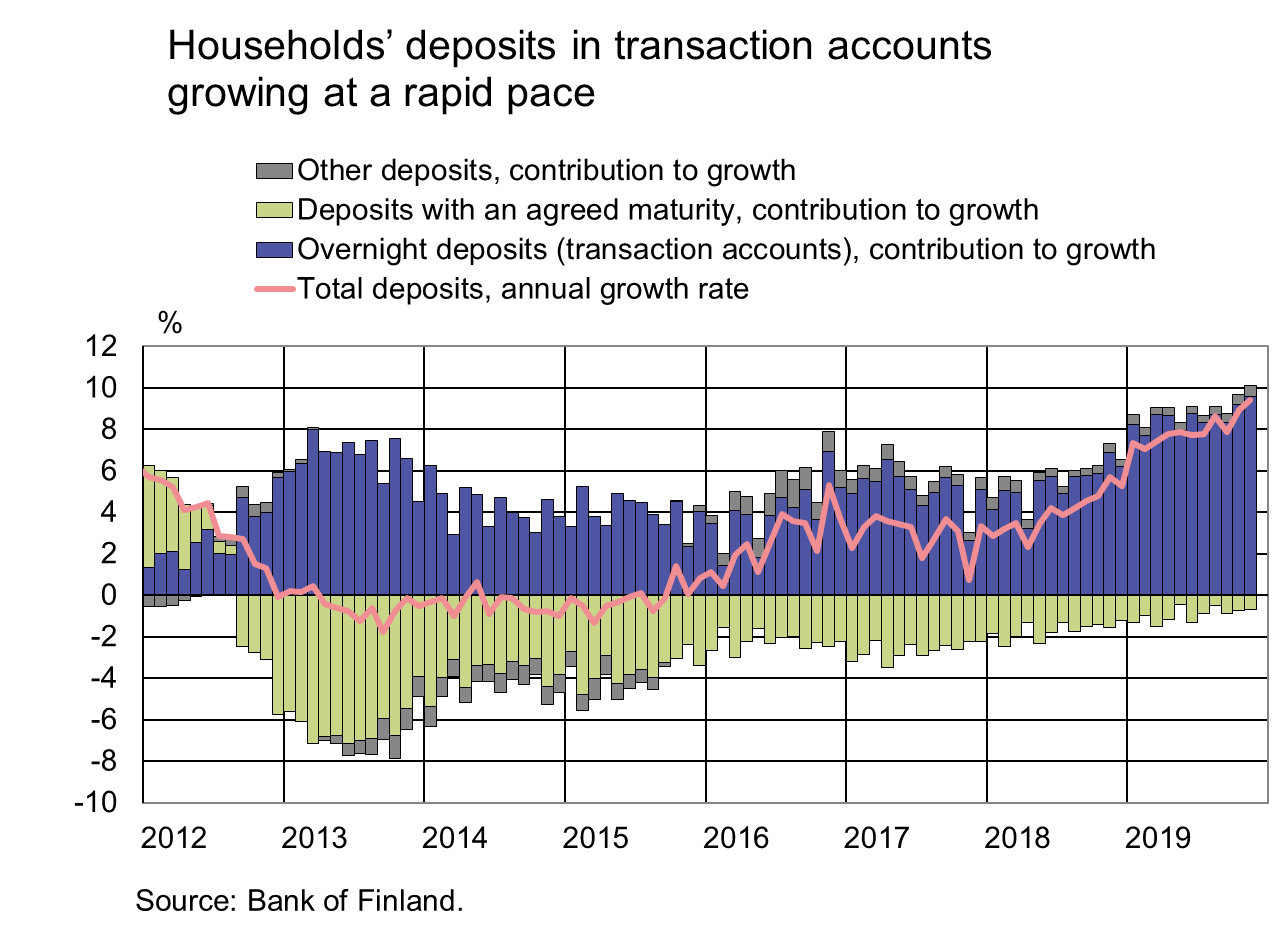

Growth in household deposits has picked up noticeably since the beginning of 2019. The acceleration started at the turn of the year, and in November household deposits already grew at an annual rate of 9.4%. The pick-up in the growth rate is particularly due to the high popularity of transaction accounts. The growth rate of funds in transaction accounts accelerated to 10% at the beginning of 2019 and was 11.3% in November. At the same time, the popularity of other deposits has increased slightly, and in November the annual growth rate of these deposits was 5.8%. The rapid contraction recorded in recent years in deposits with an agreed maturity slowed slightly, too. In November 2019, the stock of these deposits contracted at an annual rate of –11.2%. Growth rates of deposits can also be analysed now with the bank dashboard.

Loans

Households’ drawdowns of new housing loans in November 2019 amounted to EUR 1.7 bn, up by EUR 100 million on the corresponding period a year earlier. At the end of November, the stock of euro-denominated housing loans totalled EUR 100.3 bn and the annual growth rate of the stock was 2.7%. Household credit at end-November comprised EUR 16.5 bn in consumer credit and EUR 17.7 bn in other loans.

| Key figures of Finnish MFIs' loans and deposits, preliminary data | |||||

| September, EUR million | October, EUR million | November, EUR million | November, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 133,616 | 134,019 | 134,422 | 2,9 | 1,43 |

| - of which housing loans | 99,631 | 99,959 | 100,349 | 2,7 | 0,91 |

| Loans to non-financial corporations2, stock | 89,582 | 90,558 | 91,246 | 7,1 | 1,34 |

| Deposits by households2, stock | 98,561 | 98,733 | 99,559 | 9,2 | 0,10 |

| Households' new drawdowns of housing loans | 1,714 | 1,894 | 1,722 | 0,73 | |

* Includes euro-denominated loans and deposits to euro area.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release will be published at 1 pm on 31 January 2020.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.