Growth in household assets on transaction accounts

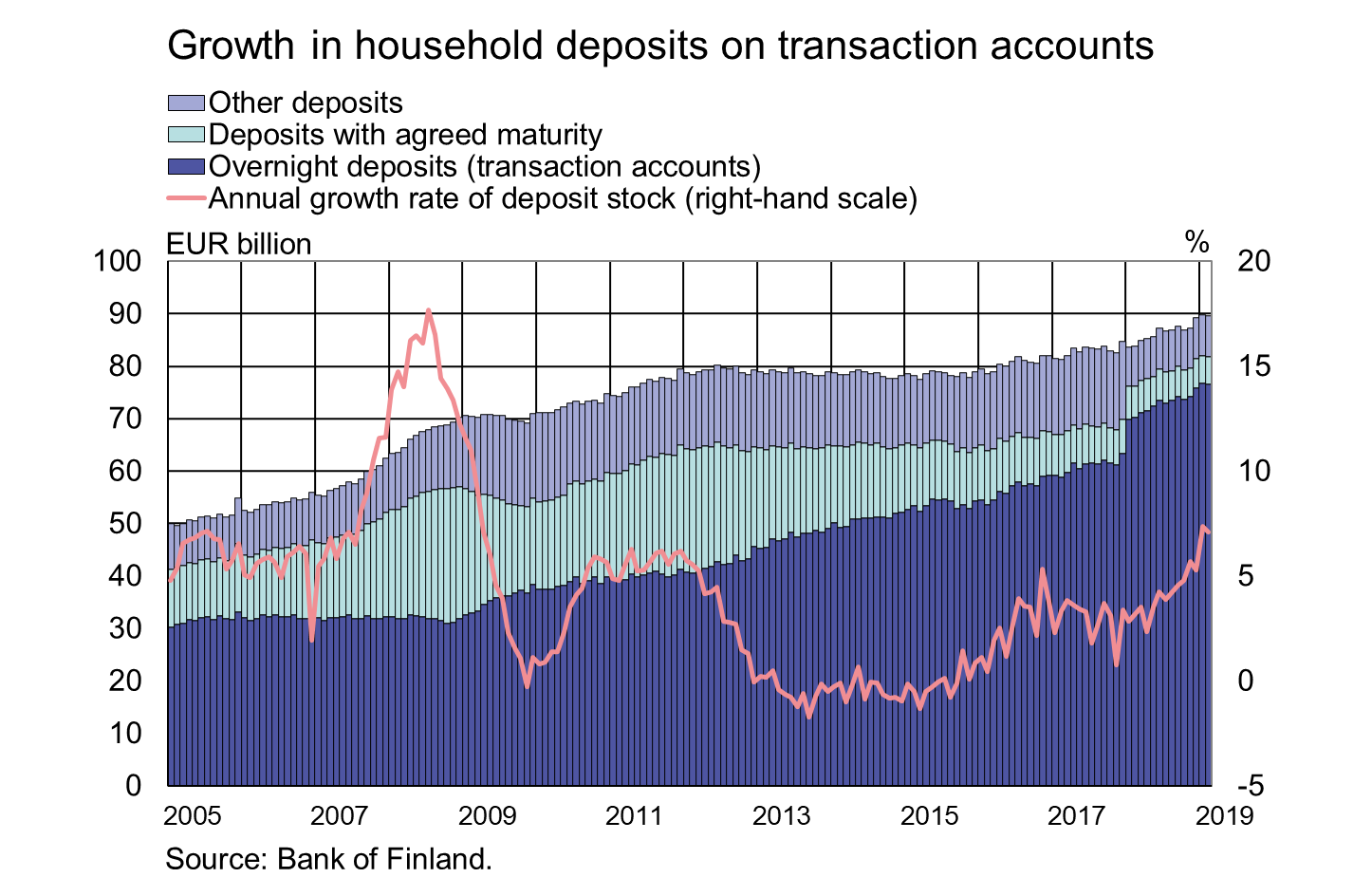

Financial assets held by Finnish households on traditional transaction accounts1 have reached a record high and their growth rate has also picked up. In February 2019, households held a total of EUR 76.6 bn on transaction accounts. The growth rate of transaction accounts was 9.2%, almost 2.3 percentage points higher than in February 2018.

Households’ interest in deposits with agreed maturity, in turn, has been weak for a long time. Over the past six years, the stock of deposits with agreed maturity has contracted by over EUR 13.4 bn. In February, the stock (EUR 5.2 bn) decreased further, at an annual rate of –14.3%.

All in all, financial assets held by Finnish households on various deposit accounts total EUR 89.7 bn.2 According to the financial accounts published by Statistics Finland, at the end of 2018, about one-third of Finnish households’ financial assets consisted of deposits.3

Interest income on deposits have declined on a broad front over the years. In February 2019, the average interest rate on deposits was 0.12%, compared with 0.14% in the year-earlier period and 0.27% in February 2016. The average interest paid on transaction accounts, on which households hold the vast majority (85%) of their financial assets, was 0.08% in February. The average interest rate on deposits with agreed maturity, in turn, was 0.51%.

Loans

Households’ new drawdowns of housing loans in February 2019 amounted to EUR 1.4 bn, which is slightly less than in the corresponding period a year earlier. The average interest rate on new housing-loan drawdowns declined from January, to 0.81%. At the end of February 2019, the stock of euro-denominated housing loans totalled EUR 97.9 bn and the annual growth rate of the stock was 1.9%. Household credit at end-February comprised EUR 15.8 bn in consumer credit and EUR 17.4 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in February to EUR 1.7 bn. The average interest rate on new corporate-loan drawdowns rose from January, to 2.16%. At the end of February, the stock of euro-denominated loans to non-financial corporations was EUR 85.9 bn, of which loans to housing corporations accounted for EUR 32.5 bn.

Deposits

In February, households concluded EUR 0.3 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.24%.

1 Transaction accounts refer to overnight deposits redeemable on demand that, in addition to daily transaction accounts, include also other household accounts that do not contain restrictive drawing provisions but can only be used for cash withdrawal or through another account.

2 The stock of deposits comprises households’ transaction accounts, deposits with agreed maturity and investment deposits. Investment deposits (deposits redeemable at notice) are non-transferable deposits without any agreed maturity which cannot be converted into currency without a period of prior notice; before the expiry the conversion into currency is not possible or possible only with a penalty.

3 Households’ financial assets include, for example, deposits, shares, insurance technical reserves and fund shares.

| December, EUR million | January, EUR million | February, EUR million | February, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 130,745 | 130,912 | 131,006 | 2,4 | 1,48 |

| - of which housing loans | 97,781 | 97,782 | 97,852 | 1,9 | 0,97 |

| Loans to non-financial corporations2, stock | 85,320 | 85,390 | 85,883 | 7,4 | 1,35 |

| Deposits by households2, stock | 92,785 | 93,478 | 93,505 | 7,1 | 0,11 |

| Households' new drawdowns of housing loans | 1,239 | 1,303 | 1,363 | 0,81 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi,

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi.

The next news release will be published at 1 pm on 2 May 2019.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.