The majority of loans to own-account workers taken out by agricultural entrepreneurs

At the end of April 2018, own-account workers1 included in the household sector had taken out EUR 8.8 bn worth of loans from credit institutions, which accounts for 7% of all loans to households. The majority of loans to own-account workers, EUR 4.8 bn, has been taken out for business purposes. However, the stock of these loans has contracted since the end of 2016. Of the other loans to own-account workers, housing loans, in particular, grew faster (5.9%) in April than housing loans to households. Due to their rapid growth, the aggregate stock of loans to own-account workers grew at an annual rate of 0.9%.

Of the loans granted for business purposes, 84% has been taken out for agriculture, forestry and fishing. The second largest categories are loans for construction (4%) and transport (3%). In over a third of the loans, the primary collateral is housing or real estate. The share is slightly higher than in the case of corporate loans (22%).

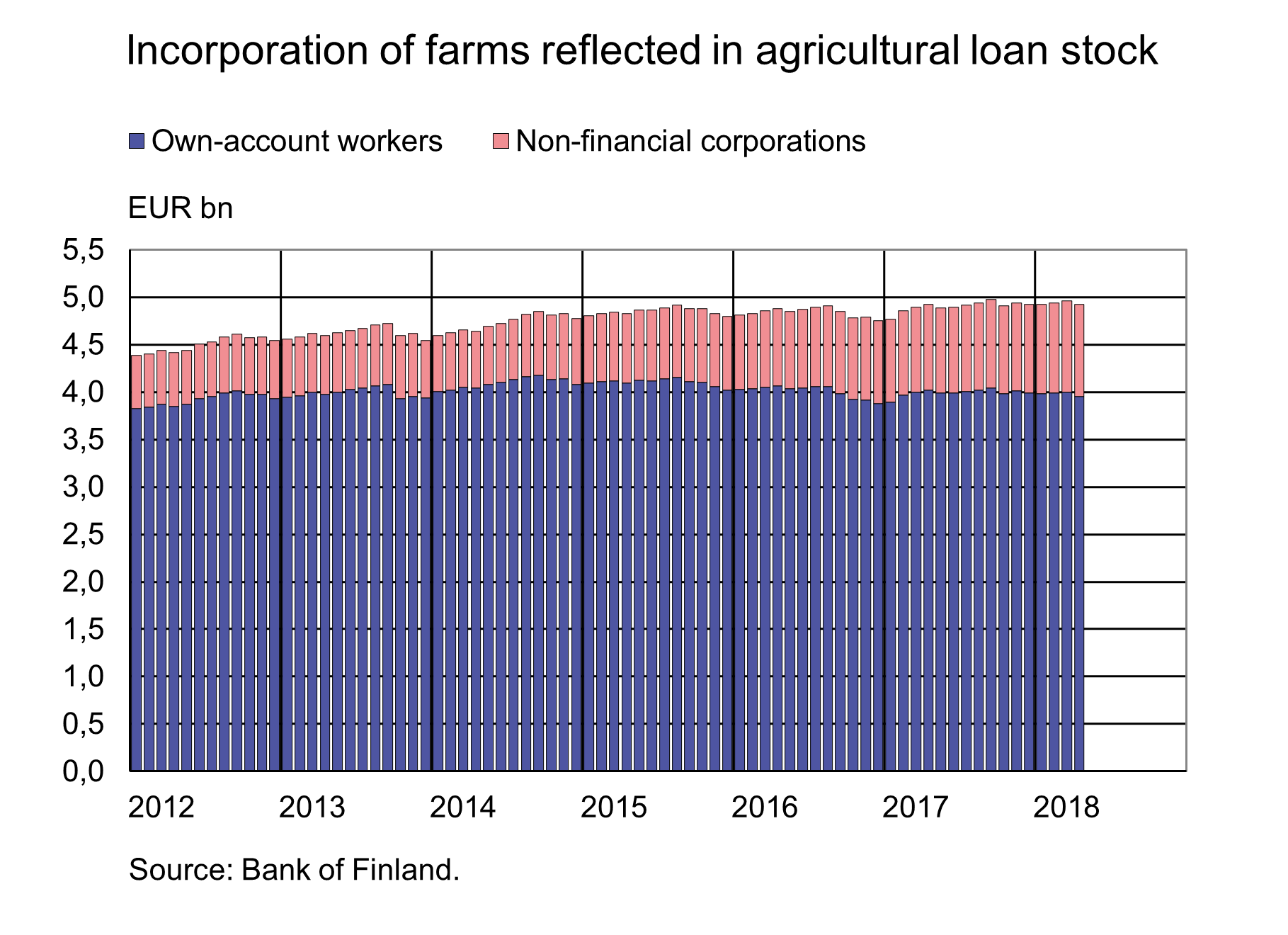

In recent years, an increasing number of farms have converted into limited liability companies. Moreover, since the beginning of 2018, incorporation of farms has no longer been subject to transfer tax. The change has also been reflected in the statistics: in April 2018, the stock of loans for private individual-type of agricultural business contracted at an annual rate of -1.6%, while the stock of loans to company-type of agriculture grew at an annual rate of 7.6% and totalled EUR 1.0 bn at end-April.

Loans

Loans

Households' new drawdowns of housing loans in April 2018 amounted to EUR 1.6 bn. The average interest rate on new housing-loan drawdowns was 0.89% and the imputed margin was 0.86%. At the end of April, the stock of euro-denominated housing loans amounted to EUR 96.3 bn and the annual growth rate of the stock was 2.0%. Household credit at end-April comprised EUR 15.4 bn in consumer credit and EUR 16.8 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.7 bn in April 2018. The average interest rate on new corporate-loan drawdowns rose from March, to 2.24%. The stock of euro-denominated loans to non-financial corporations at end-April was EUR 81.2 bn, of which loans to housing corporations accounted for EUR 29.4 bn.

Deposits

At the end of April 2018, the stock of household deposits totalled EUR 85.3 bn, and the average interest rate on the deposits was 0.13%. Overnight deposits accounted for EUR 65.1 bn and deposits with agreed maturity for EUR 6.2 bn of the deposit stock. In April, households concluded EUR 0.3 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.33%.

1Own-account workers are households whose largest income source is income from the production of goods and services. If a business name employs at least two persons, on average, it is not classified in the household sector but instead in the non-financial corporations sector, as a quasi-corporation.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| February, EUR million | March, EUR million | April, EUR million | April, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 128,101 | 128,425 | 128,528 | 2,4 | 1,50 |

| - of which housing loans | 95,998 | 96,237 | 96,307 | 2,0 | 1,00 |

| Loans to non-financial corporations2, stock | 79,786 | 80,959 | 81,224 | 4,2 | 1,40 |

| Deposits by households2, stock | 87,324 | 88,492 | 89,171 | 2,7 | 0,13 |

| Households' new drawdowns of housing loans | 1,367 | 1,494 | 1,584 | 0,89 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi,

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi.

The next news release will be published at 1 pm on 29 June 2018.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.