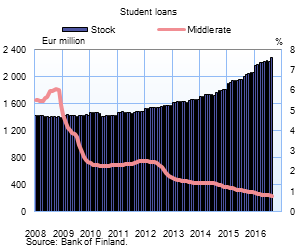

Students increasingly financing their studies with student loans

|

In 2016, drawdowns of student loans totalled EUR 339 million by the end of September. Over the same period in 2015, drawdowns totalled EUR 307 million, and in 2014, EUR 221 million. The stock of student loans has grown almost 30 % in two years, and at the end of September 2016 stood at EUR 2.3 billion. A contributory factor to the growth in the stock of student loans was the reform of financial aid for students that came into force in 2014 and has caused students to turn more to student loans. As a result of this reform, students in tertiary education who graduate within the normative time frame can receive a compensation payment for part of their loan. The reform was designed to transfer more of the costs of financing studies onto student loans.

|

|

|

Extremely low interest rates have also made the student loan a more attractive way to finance university studies. The annual interest rate set for new student loans taken out in September was 0.67%, and the overall annual interest on the stock of student loans was 0.75%. For the corresponding period of 2014, annual interest on new student loans was 1.16%, and on the loan stock, 1.32%. Students’ weak employment situation makes it harder to fund their studies with part-time work, which has possibly helped increase demand for student loans. In particular, there have been less summer jobs available for students than previously, and students may have continued studying during the summer months with the support of their student loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit cards) amounted to EUR 1.8 billion in September. The average interest on new corporate loans was down from August, to 1.84%. The stock of euro-denominated corporate loans at the end of September stood at EUR 74.9 billion, of which loans to housing companies accounted for EUR 25.2 billion. |

|

Deposits The stock of household deposits at the end of September amounted to EUR 84.1 billion, and the average interest payable on these deposits was 0.20%. Of the aggregated stock of deposits, overnight deposits accounted for EUR 60.3 billion and deposits with agreed maturity for EUR 9.3 billion. In September, households concluded EUR 0.6 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.44%. Notes: |

Key figures of Finnish MFIs' loans and deposits, preliminary data

| July, EUR million | August, EUR million | September, EUR million | September, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 123,888 | 124,112 | 124,498 | 2,8 | 1,59 |

| - of which housing loans | 93,293 | 93,386 | 93,647 | 2,5 | 1,11 |

| Loans to non-financial corporations2, stock | 74,464 | 74,575 | 74,923 | 4,5 | 1,52 |

| Deposits by households2, stock | 85,128 | 84,294 | 84,079 | 3,8 | 0,20 |

| Households' new drawdowns of housing loans | 1,372 | 1,446 | 1,595 | 1,16 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact:

Anne Turkkila, tel. +358 10 831 2175, email: anne.turkkila(at)bof.fi,

Markus Aaltonen, tel. +358 10 831 2395, email: markus.aaltonen(at)bof.fi.

The next news release will be published at 1 pm on Wednesday 30 November 2016.

Related statistical data and graphs are also available on the Bank of Finland website:

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.

You can also subscribe to the monthly Loans, deposits and interest rates –newsletter to your email from the Bank of Finland website