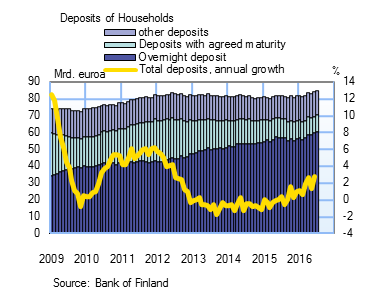

Households’ overnight deposits have increased to EUR 60 bn

In July 2016, households' overnight deposits, i.e. the stock of deposits in traditional transaction accounts, rose to a record level, above EUR 60 bn. The amounts of these deposits have steadily increased over the last three years, by a total of EUR 10.7 bn, although the interest rate paid on transaction accounts is the lowest of the deposit rates (0.13%). In the same period the stock of deposits with agreed maturity has in turn declined by EUR 7.7 bn, to EUR 9.8 bn at the end of July. Households have clearly not wished to bind their assets at a low interest rate in deposits with agreed maturity, but prefer to keep them in accounts from which they are easily transferable to other use. Overall, Finnish households' total assets in different deposit accounts exceed EUR 85 bn. This is more than ever before and equivalent to nearly 90% of households' stock of housing loans. In one year the stock of deposits has increased by EUR 3.4 bn. |

|

As the stock of deposits has increased, the interest income has, however, decreased throughout the sector. In July, the average interest rate on deposits was 0.22%, against an 0.1 percentage point higher rate one year earlier. The average interest rate on overnight deposits was in turn 0.13% and on deposits with agreed maturity 0.80% in July 2016, as compared to 0.20% and 1.07% one year earlier. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.5 bn in July 2016. The average interest rate on the drawdowns rose from June to 2.00 %. At the end of July, the stock of euro-denominated loans to non-financial corporations was EUR 74.5 bn, of which loans to housing corporations accounted for EUR 24.6 bn. |

Deposits In July, households concluded EUR 0.7 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.46%. Notes: |

Key figures of Finnish MFIs' loans and deposits, preliminary data

| May, EUR million | June, EUR million | July, EUR million | July, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 123,009 | 123,566 | 123,888 | 2,8 | 1,61 |

| - of which housing loans | 92,707 | 93,087 | 93,293 | 2,6 | 1,13 |

| Loans to non-financial corporations2, stock | 73,665 | 74,261 | 74,464 | 4,6 | 1,53 |

| Deposits by households2, stock | 83,241 | 84,151 | 85,128 | 4,1 | 0,22 |

| Households' new drawdowns of housing loans | 1,748 | 1,805 | 1,349 | 1,18 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi,

Anne Turkkila, tel. +358 10 831 2175, email: anne.turkkila(at)bof.fi.

The next news release will be published at 1 pm on 30 September 2016.

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.