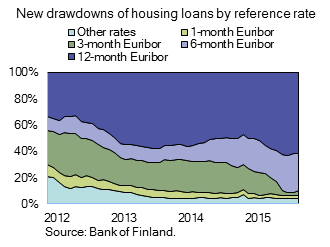

New housing loans increasingly seldom linked to shortest Euribor rates

The bulk of Finnish households’ housing loans are linked to Euribor rates. In October 2015, as much as 96% of new housing loans were Euribor-linked. The share of other interest rates, such as prime rates and fixed interest rates, has diminished to near-marginal significance. The shortest Euribor rates have turned negative for the first time in 2015. The 1-month Euribor entered negative territory in January, followed by the 3-month Euribor in April and the 6-month Euribor in November. As Euribor rates have become negative, banks have reduced their use of them as reference rates for new housing loans. At the beginning of 2015, 19% of new housing loans were still linked to the 3-month Euribor, compared to just 4% in October 2015. Even fewer housing loans are linked to the 1-month Euribor. The most frequently used reference rate in October was the 12-month Euribor, with 62% of new housing loans linked thereto. In October, 28% of new housing loans were linked to the 6-month Euribor. |

|

Loans

In October 2015, households’ new drawdowns of housing loans amounted to EUR 1.5 bn, which is about EUR 0.1 bn more than a year earlier in October. The stock of euro-denominated housing loans totalled EUR 91.8 bn at the end of October, and the annual growth rate of the housing loan stock was 2.4%. At the end of October, household credit comprised EUR 14.0 bn in consumer credit and EUR 16.0 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in October to EUR 2.0 bn. The average interest rate on new corporate-loan drawdowns declined from September, to 1.90%. The stock of euro-denominated loans to non-financial corporations at the end of October was EUR 71.7 bn, of which loans to housing corporations accounted for EUR 23.0 bn. | ||||||||||||||||||||||||||||||||||||

Deposits At the end of October, the stock of household deposits totalled EUR 81.8 bn, and the average interest rate on the deposits was 0.32%. Overnight deposits accounted for EUR 56.2 bn and deposits with agreed maturity for EUR 11.0 bn of the total deposit stock. In October, households concluded EUR 0.7 bn of new agreements on deposits with agreed maturity. The average interest rate on these declined from September, to 0.90% in October.

| ||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

For further information, please contact The next news release will be published at 1 pm on 1 January 2016. |