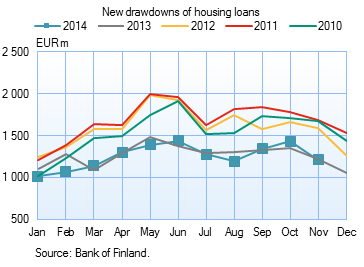

Growth of housing loan stock slowed down towards year-end

New housing loan drawdowns in November amounted to EUR 1.2 bn, which is slightly less than in the same period a year ago. Demand for new housing loans typically subsides towards the end of the year. Overall, households' new drawdowns of housing loans in 2014 have been moderate, totalling EUR 13.9 bn, which is EUR 0.3 bn less than in January-November 2013. The annual growth rate of the housing loan stock was only 1.6% in November 2014, compared to 2.6% in the same period a year earlier. |

|

Simultaneously with the slowing of growth in the housing loan stock, banks’ customer-specific loan margins have narrowed. The average housing loan margin calculated by the Bank of Finland was 1.45% at the end of November 2014, compared to 1.56% still at the beginning of the year.

The stock of euro-denominated housing loans amounted to EUR 89.8 bn at the end of November, and the average interest rate was 1.45%. At the end of November, household credit comprised EUR 13.6 bn in consumer credit and EUR 15.6 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in November to EUR 1.8 bn, which is about EUR 0.8 bn less than in November 2013. The average interest rate on new corporate-loan drawdowns decreased from October, to 2.35%. The stock of euro-denominated loans to non-financial corporations at the end of November was EUR 67.9 bn, of which loans to housing corporations accounted for EUR 21.0 bn. | ||||||||||||||||||||||||||||||||||||||||||

Deposits At the end of November, the stock of household deposits totalled EUR 80.4 bn, and the average interest rate on these deposits was 0.38%. Overnight deposits accounted for EUR 54.2 bn and deposits with agreed maturity for EUR 12.9 bn of the total deposit stock. In November, households concluded EUR 0.9 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.04%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1 pm on 30 January 2015. |