Demand for interest-only housing loans continued strong in March

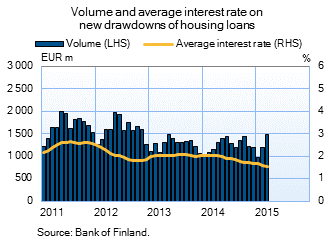

Credit institutions' free provision of interest-only periods on housing loans, which was launched in February, continued to attract households in March. Households renegotiated EUR 2.4 bn worth of housing loan agreements in March 2015. Since the start of credit institutions' campaign for interest-only periods, households have renegotiated housing loans totalling EUR 5.5 bn. Households' renegotiations typically average about EUR 0.2 bn per month. During interest-only periods, households do not repay loan capital but only pay interest on the loan. The low level of interest rates has kept the interest expenses low for households whose housing loans are tied to market rates. In March, the interest expenses on new drawdowns of housing loans decreased further due to the ECB's accommodative monetary policy, as well as the narrowing of margins. In March, the average interest rate on new housing-loan drawdowns was 1.54%, compared to 1.60% in February. |

|

In March 2015, new drawdowns of housing loans amounted to EUR 1.5 bn. Monthly figures show that the amount of the drawdowns was largest since November 2012. At the end of March, the stock of euro-denominated housing loans totalled EUR 89.9 bn, and the annual growth rate of the stock was 1.7%. At end-March, household credit comprised EUR 13.5 bn in consumer credit and EUR 15.7 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in March to EUR 2.4 bn, which is almost as much as in March 2014. The average interest rate on corporate-loan drawdowns decreased by 0.6 percentage point from February, to 1.95% in March. At end-March, the stock of euro-denominated loans to non-financial corporations was EUR 69.7 bn, of which loans to housing corporations accounted for EUR 21.7 bn. | ||||||||||||||||||||||||||||||||||||||||||

At the end of March, the stock of household deposits totalled EUR 80.4 bn. The average interest rate on the deposits was 0.36%. Overnight deposits accounted for EUR 54.8 bn and deposits with agreed maturity for EUR 12.4 bn of the total deposit stock. In March, households concluded EUR 1.3 bn of new agreements on deposits with agreed maturity, at an average interest rate of 1.02%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1 pm on 1 June 2015. |