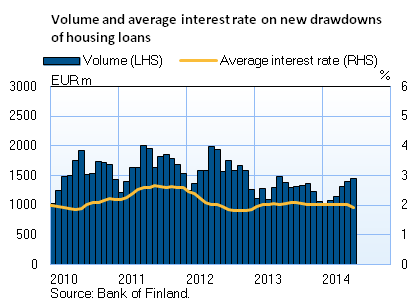

Interest rates on new housing loans decreased in June in line with the fall in Euribors

The average interest rate on new housing loans has remained at around 2% for one year, but in June 2014 it fell to 1.92%. The decrease in the average interest rate on new housing loans is due to the fall in Euribors. The fall in Euribors is a result of the ECB's monetary policy decisions in June, according to which the key interest rate was reduced and the deposit rate taken into negative territory. Euribors are the most widely used reference rates for housing loans of Finnish households, and in June, 96% of the new housing loans were tied to Euribors. The last time the average interest rate on new housing loans was at such a low level was in December 2012, when it was 1.84%. In June the imputed housing loan margin remained unchanged at the May level of 1.49%. New drawdowns of housing loans increased slightly in June 2014 from the comparable time in 2013. In spite of the moderate upswing in drawdowns in June, households' new drawdowns of housing loans in the first half of the year amounted to a total of EUR 7.4 bn, which was EUR 0.3 bn less than in the first half of 2013. |

|

Loans Households' new drawdowns of housing loans in June 2014 amounted to EUR 1.4 bn. The average interest rate on new housing-loan drawdowns was 1.92%, down by 0.08 percentage point on May. The stock of euro-denominated housing loans to households amounted to EUR 89.0 bn at the end of June and the annual growth of the stock of housing loans was 1.8%. At the end of June, household credit comprised EUR 13.4 bn in consumer credit and EUR 15.3 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.9 bn in June 2014, which was EUR 0.1 bn less than in June 2013. The average interest rate on new loans to non-financial corporations fell from May, to 2.02% in June. The stock of euro-denominated loans to non-financial corporations was EUR 66.6 bn at the end of June, of which loans to housing corporations accounted for EUR 20.0 bn. | ||||||||||||||||||||||||||||||||||||||||||

Deposits At the end of June 2014, the stock of household deposits totalled EUR 81.8 bn, and the average interest rate on the stock was 0.43%. Overnight deposits accounted for EUR 53.3 bn and fixed-term deposits for EUR 14.7 bn of the deposit stock. In June, households concluded new fixed-term deposit contracts for EUR 1.1 bn. The average interest rate on new fixed-term deposits was 1.09% in June. Notes: | ||||||||||||||||||||||||||||||||||||||||||

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published on 29 August 2014 at 1.00 pm. |