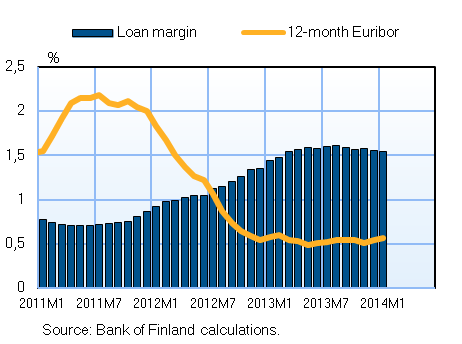

Interest rate on new housing loans stabilised at about 2%

In Finland, the stock euro-denominated housing loans contracted by just under EUR 30 m in January, continuing the negative trend observed in December. As throughout 2013, the average interest rate on new housing-loan drawdowns remained around 2% in January. The imputed interest margin was 1.54%, compared to 1.44% at the beginning of 2013. The imputed interest margin is the difference between the annualised agreed rate and the reference rate. In Finland, 95% of new housing loan drawdowns are tied to Euribor rates. Fixed-rate agreements have become markedly less popular in the past two years: at the beginning of 2012 they accounted for almost 10% of new housing loans, compared to 3% in January 2014.

Loans

In January 2014, households’ new drawdowns of housing loans amounted to eur 1 bn, which was EUR 0.1 bn less than a year earlier in January. The average interest rate on new housing-loan drawdowns was 2.03%, the same as in December 2013. At the end of January, the stock of euro-denominated housing loans was EUR 88.3 bn and the average interest rate on the stock was 1.49%. The annual growth rate of the housing loan stock moderated further, to 2.2%. At end-January, household credit comprised EUR 13 bn in consumer credit and EUR 15 bn in other loans.

In January 2014, new drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.9 bn, which was EUR 0.5 bn less than in January 2013. The average interest rate on new corporate-loan drawdowns fell from December, to 2.23%. At the end of January, the stock of euro-denominated loans to non-financial corporations was EUR 64.6 bn, of which loans to housing loan corporations accounted for EUR 18.9 bn.

Deposits

At the end of January, the stock of household deposits totalled EUR 81 bn. The average interest rate on the stock was 0.45%. Overnight deposits accounted for EUR 52.1 bn and deposits with agreed maturity for EUR 15.2 bn of the total deposit stock. In January, households concluded EUR 1.2 bn of new agree-ments on deposits with agreed maturity. The average interest rate on these was 1.15%.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| November, EUR million |

December, EUR million |

EUR million |

January, 12-month change1, %

|

Average interest rate, % | |

| Loans to households2, stock | 116,625 | 116,622 | 116,736 | 2,4 | 1,92 |

| - of which housing loans | 88,367 | 88,313 | 88,286 | 2,2 | 1,49 |

| Loans to non-financial corporations2, stock | 66,365 | 66,724 | 64,596 | 3,6 | 1,99 |

| Deposits by households2, stock | 81,243 | 81,780 | 81,242 | -0,8 | 0,45 |

| Households' new drawdowns of housing loans | 1,221 | 1,057 | 1,017 | – | 2,03 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

For further information, please contact:

Essi Tamminen, tel. +350 10 831 2395, email: essi.tamminen (at)bof.fi.

The next news release will be published at 1 pm on 31 March 2014.

The releted statistical data and graphs are also availabel on the Bank of Finland website: http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.