Average interest rate on new housing loan drawdowns declined in August

Loans

Loans

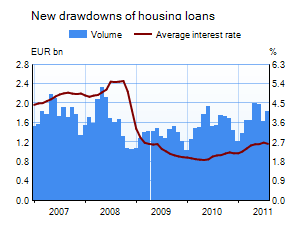

Households’ new drawdowns of housing loans amounted to EUR 1.8 bn in August 2011, which was EUR 0.2 bn more than in July 2011 and EUR 0.3 bn more than in August 2010. The average interest rate on new housing loan drawdowns declined by 0.06 percentage point, to 2.61%. The monthly change in the average interest rate on new housing loan drawdowns was negative last time in December 2010. The stock of euro-denominated housing loans granted to households by Finnish MFIs grew by EUR 0.4 bn in August, to EUR 80.0 bn at month-end. The annual growth rate of the stock of housing loans to households remained almost unchanged at 6.7%. The average interest rate on the housing loan stock rose by 0.04 percentage point month-on-month, to 2.46% at end-August.

New loan agreements with non-financial corporations totalled EUR 7.1 bn in August 2011, which was EUR 0.1 bn more than in July 2011 and EUR 0.8 bn more than in August 2010. The average interest rate on new loan agreements continued to fall. In August it was 0.05 percentage point lower than in July, ie 2.70%. The stock of euro-denominated loans to non-financial corporations continued to grow: at end-August the stock was EUR 0.1 bn more than in July, ie EUR 59.0 bn. The average interest rate on the stock rose by 0.02 percentage point, ie to 2.89% and the annual growth rate declined to 4.3% from 4.5% in July. Foreign currency loan agreements with non-financial corporations have been granted more than average in recent months. In August, non-financial corporations contracted EUR 0.7 bn worth of new foreign currency loans. The average interest rate on new loan agreements was 2.62%.

Deposits

The stock of household deposits was EUR 80.5 bn at end-August. The stock contracted by EUR 0.3 bn on July, and the average interest rate remained unchanged at 0.99%. In August, households’ new deposits with agreed maturity totalled EUR 2.4 bn. The average interest rate on new deposits with agreed maturity declined by 0.03 percentage point on July, ie to 2.19%.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| June, EUR million |

July, EUR million |

EUR million |

August, 12-month change1, % |

Average interest rate, % | |

| Loans to households2, stock | 106.731 | 107.204 | 107.804 | 5.7 | 2.84 |

| - of which housing loans | 79.102 | 79.539 | 79.982 | 6.7 | 2.46 |

| Loans to non-financial corporations2, stock | 58.672 | 58.951 | 59.001 | 4.3 | 2.89 |

| Deposits by households2, stock | 80.113 | 80.822 | 80.534 | 5,9 |

0.99 |

| Households' new drawdowns of housing loans | 1.959 | 1.626 | 1.818 | – | 2.61 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

More information:

Hanna Häkkinen, tel. +358 10 831 2552, email: hanna.hakkinen(at)bof.fi

Jussi Pajunen, tel. +358 10 831 2343, email: jussi.pajunen(at)bof.fi

The next news release will be published at 1 pm on 31 October 2011.