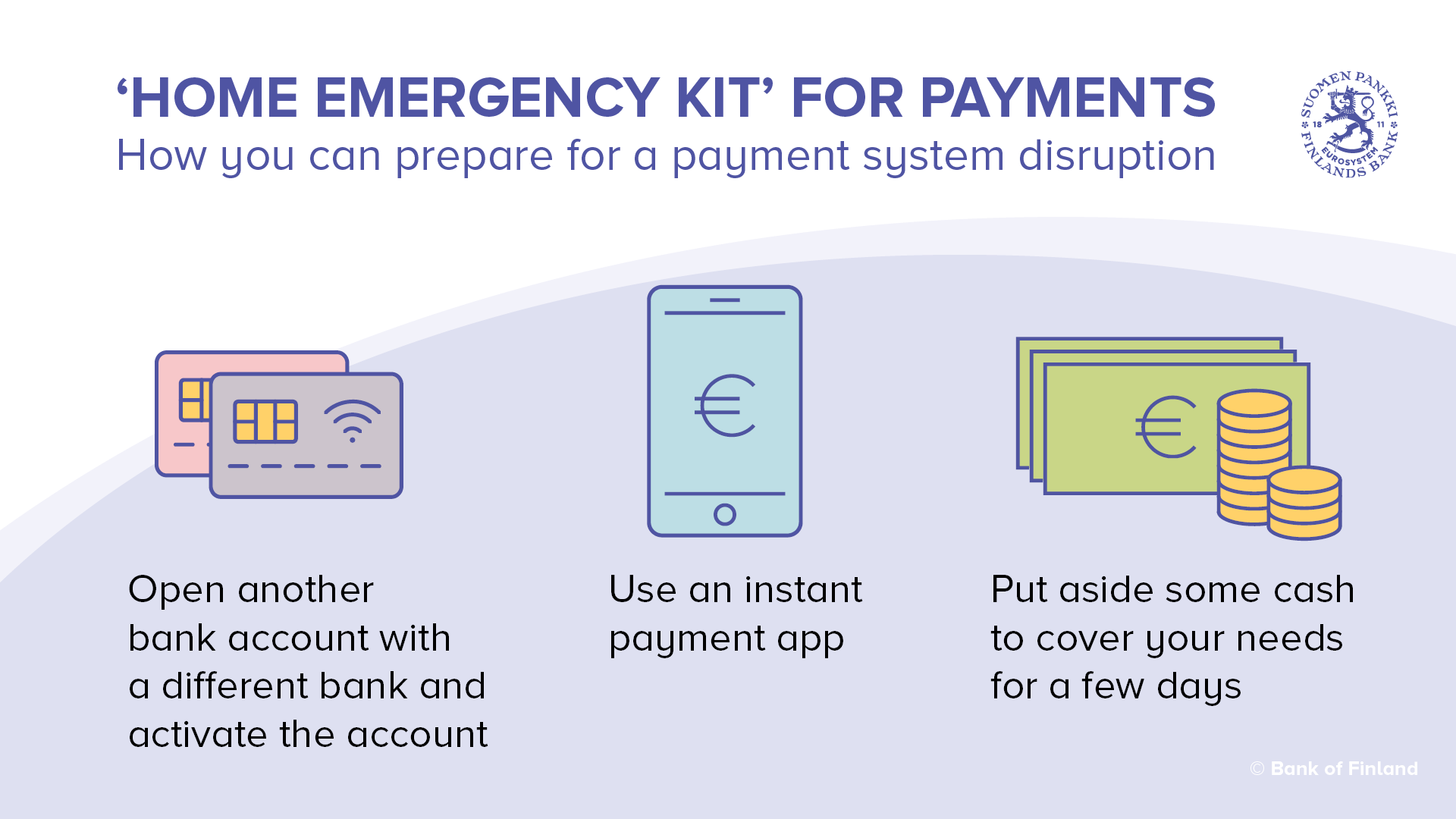

‘Home emergency kit’ for payments

For society as a whole it is of considerable importance that households have preparations in place for any disruptions in payment systems, but such preparedness will be especially important for household members themselves. That’s why each of us ought to make sure we are prepared. Geopolitical uncertainties are increasing the likelihood of cyber risks and other external influencing in the financial sector as well. Preparedness in the financial sector and among the authorities is at a good level.

Open another account with a different bank and activate the account

It would be useful if households were to have bank accounts, online banking codes and payment cards in two different banks in case the services of one bank are disrupted for a period of time. It is also worth activating the online and mobile banking services for these accounts. Make sure, too, that your personal details and contact information are up to date.

Online banking codes are used not only for payments but also for online identification needs in many different services where reliable identification is required. A good alternative to online banking codes is a mobile ID from a telecommunications operator.

Use an instant payment app

To improve the certainty of being able to manage your everyday money matters in all situations, you could start using alternative means of payment, such as mobile apps. An instant payment app, such as one based on the Finnish Siirto system, could provide a solution in the event of card payments being disrupted. Siirto transmits payments in real time between accounts in the participating banks.

Keep cash for sevaral days´ needs

A small amount of cash is good to have at home as part of a normal level of preparedness. The recommendation is to have enough for three days. Take a moment to think about how much your household would need over such a 72-hour period if you could not use payment cards. It is not advisable, however, to keep large amounts of cash at home.