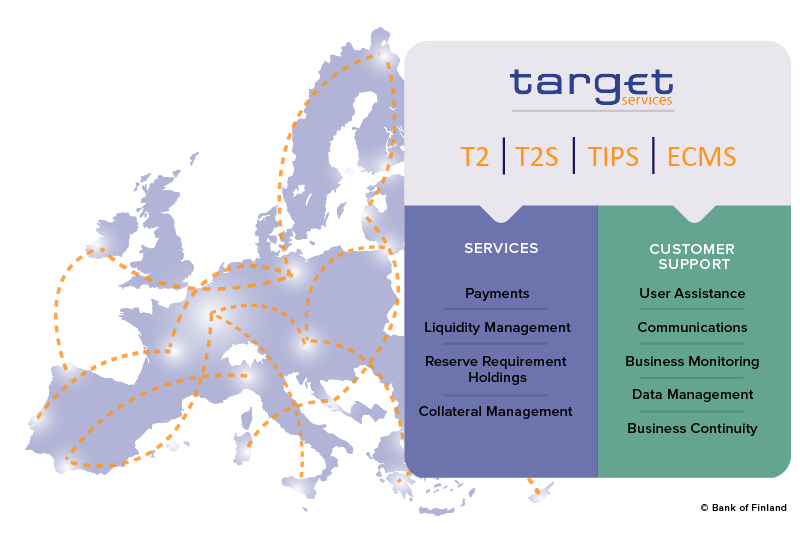

TARGET services

TARGET Services refer to the market infrastructure services, operated and developed by the Eurosystem, that enable cash, securities and collateral to move freely across Europe.

TARGET Services refer to the following market infrastructure services:

- T2 (payment settlement)

- T2S (securities settlement)

- TIPS (instant payment service)

- ECMS (collateral management system).

T2 is a payment system owned and operated by the Eurosystem. It consists of two components: CLM for central liquidity management and RTGS for real-time interbank and customer payments as well as ancillary system (AS) settlement. Central banks, credit institutions and ancillary systems can submit cash transfer orders (i.e. payment orders, liquidity transfer orders and AS transfers orders) to T2, where they are processed and settled in central bank money. T2 settles payments related to the Eurosystem’s monetary policy operations as well as interbank and commercial transactions. In addition, major payment systems, e.g. CLS, EURO1 and STEP2, use T2 for settlement purposes. T2 provides its customers with harmonised services, harmonised prices and other terms and conditions in all the participating countries. In Finland, these services are provided by the component system TARGET- Suomen Pankki.

TARGET2-Securities (T2S) is a European securities settlement platform that offers centralised delivery-versus-payment (DvP) settlement in central bank money. Currently, 24 central securities depositories from 23 European countries have joined the platform, and Euroclear Finland, the settlement party for Finnish securities trades, migrated to T2S on 11 September 2023.

The main objective of T2S is to integrate and harmonise the highly fragmented securities settlement infrastructure in Europe and provide a common settlement platform for the single European market. The objective of T2S is also to reduce the costs of cross-border securities settlement and increase competition and choice among the various service providers. Moreover, T2S enhances the collateral and liquidity management of market participants engaged in securities trading.

The Bank of Finland opens T2S dedicated cash accounts for its customers and provides liquidity management services in T2S. The central banks of Germany, Italy, France and Spain are together responsible for the daily operation of the service platform.

TARGET Instant Payment Settlement (TIPS) is a market infrastructure service that enables payment service providers to offer fund transfers to their customers in real time and around the clock, every day of the year. TIPS settles payments in central bank money, and participating payment service providers set aside part of their liquidity in a TIPS dedicated account. To open an account in TIPS in euro, an institution needs to fulfil the same eligibility criteria as for participating in T2. The Bank of Finland opens TIPS dedicated cash accounts for its customers and provides liquidity management services in TIPS. All payment service providers that adhere to the SCT Inst scheme and are reachable in T2 are also reachable in TIPS, either as a participant or as a reachable party.

Eurosystem Collateral Management System (ECMS) is the future collateral management system used by Eurosystem central banks and their monetary policy counterparties. The ECMS is planned to go-live in November 2024. The ECMS will manage assets used as collateral in Eurosystem credit operations. More information about the ECMS project is published by the ECB.