Payment and settlement systems

Payment systems – payment infrastructures – refer to multilateral arrangements and systems that are used for transferring electronic payments between payer and payee.

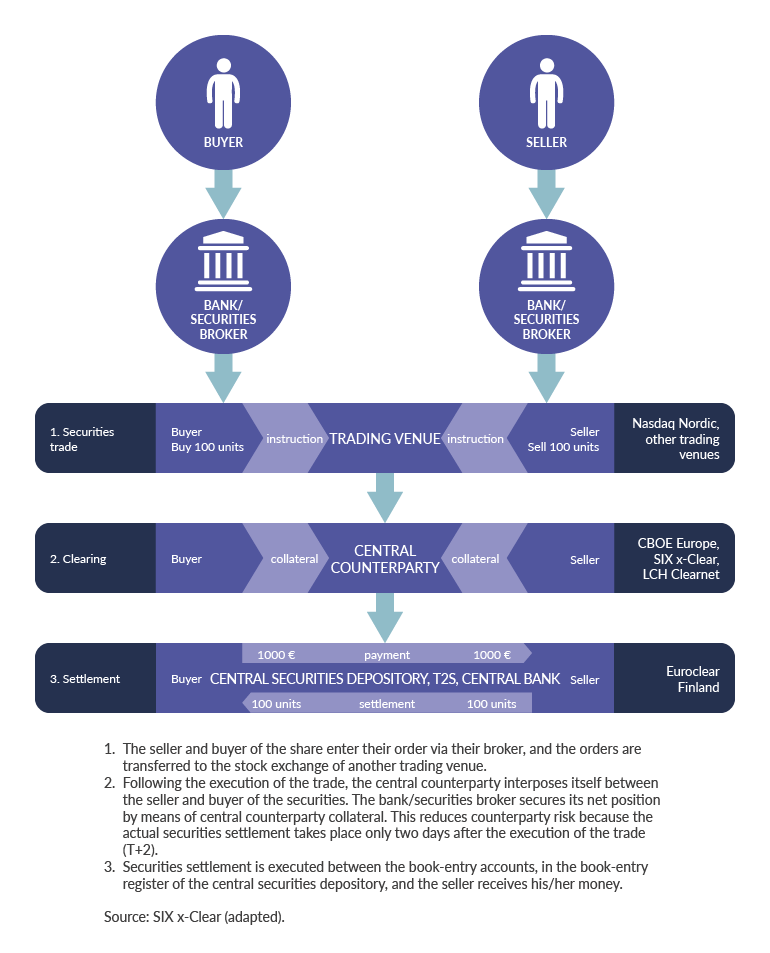

Settlement systems – securities infrastructures – refer to multilateral arrangements and systems that are used for the clearing, settlement and recording of payments, securities, derivatives or other financial transactions. Securities settlement systems are used for post-trade processing.

Payment systems

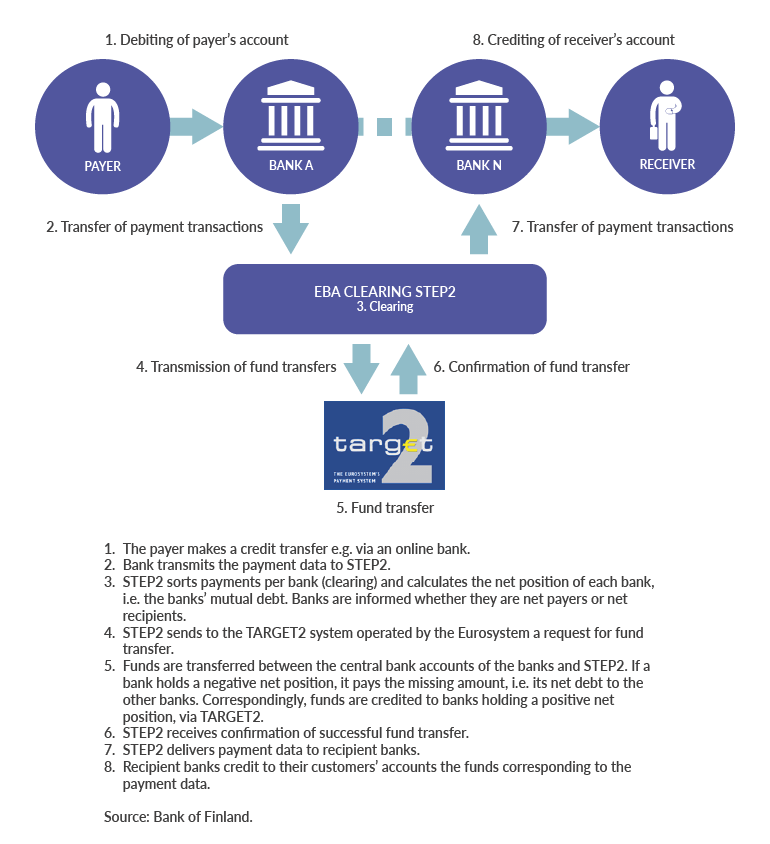

For Finland, the most significant system related to retail payments is the pan-European STEP2 system, managed by EBA Clearing and used by banks operating in Finland for the processing of credit transfers and direct debits in Finland and throughout the euro area. STEP2 sorts the payments received from banks per recipient bank and calculates, based on outgoing and incoming payments, a net credit or debit position for each bank. This process is referred to as clearing. After clearing, settlement is effected in T2, the participant banks' accounts.

T2 is a pan-European automated real-time gross settlement system operated by the Eurosystem. Banks maintain liquidity in T2 for the processing of payments. Following the transfer of funds in T2, banks receive information on the individual payments and record the payments to their customers' accounts. The clearing and settlement of Finnish credit transfers take place, as a rule, several times a day, no later than after midnight for payments executed on the previous day.

Transmission of SEPA credit transfers via STEP2

The other payment systems used by Finnish banks are TIPS, POPS, EURO1, RT1 and CLS. TIPS (TARGET Instant Payment Settlement) is a pan-European real-time payment service operated by the Eurosystem in which fund transfers take place in central bank money, at any time of day and on any day of the year. POPS is the domestic banks’ online payment system for interbank express transfers and cheques. EURO1 is a large-value payment system operated by EBA Clearing. It processes domestic and cross-border transactions in euro, both customer payments and interbank payments. EURO1 is a multilateral net settlement system in which the funds for the settlement of payments are transferred via TARGET2 once a day in the afternoon. RT1 is a system for the execution of SEPA Instant Credit Transfers (SCT Inst), maintained by EBA CLEARING. CLS (Continuous Linked Settlement) is a global multilateral netting system for foreign exchange transactions, operating on the payment-versus-payment (PvP) principle. The system is operated by CLS Bank. All these systems use T2 for the settlement of euro-denominated payments.

Settlement systems

Securities issued by a Finnish entity can be entered in the book-entry system of a Finnish or foreign central securities depository. The issuer can be either a company or a government. Despite the issuer’s right to choose, securities issuance and securities in the EU are subject to national company law or other similar law. Following entry in the book-entry system, the securities can be traded publicly on a stock exchange or other trading venue. The instrument subject to trading can also include the various rights or obligations related to book entries.

Clearing refers to the procedure by which a central counterparty interposes itself between the seller and the buyer of the securities traded. The central counterparty thus carries the risk related to the counterparties' ability to fulfil their obligations. It settles the net positions of the clearing parties per instrument. The net position per counterparty and instrument is transferred to the central security depository's system for settlement. Central counterparty services in Finland currently only cover stock market instruments.

Securities settlement is executed between the book-entry accounts, in the book-entry register of the central securities depository, and the seller receives its money. In Finland, the clearing party and the book-entry registrar are often one and the same entity that, based on transactions, records entries directly in the book-entry system of the central securities depository and records the cash amounts on its own behalf or on its customer’s behalf.

The chart gallery shows the development of the volume and value of trades settled by Euroclear Finland.

Trade execution process